Pet stores put focus on personalized pet care

Man’s best friend may be a dog or a cat, or it may be something more exotic. Whatever the species, pet owners love to pamper their pets and that, combined with the growth in pet ownership, has created a big market opportunity for the pet retail sector.

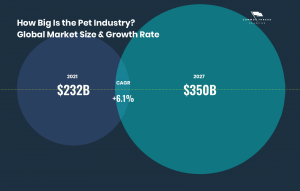

After the demand shock in 2020, when sales of pet-related food and products rocketed during the pandemic as owners pampered their pets even more, market growth is expected to ease back to a compound annual growth rate of 6.1% over the next few years, with the global market predicted to grow to $350bn in 2027.

Pet food is the biggest selling category in the pet supplies market and pet owners will often joke that they spend more on pet food than they do on feeding themselves. The idea of gourmet pet food might once have seemed a strange one but just as their owners have embraced healthy lifestyles and balanced diets, so too have their pets.

Specialty pet retail stores have learned to cater for these new needs and expand their assortments to include gluten-free and even vegan dog food, as well as a growing range of non-food items for their pets, including not just toys but clothing, bedding, shampoo and cologne.

As with every retail segment, e-Commerce is making big inroads into the pet care market. The pet supplies category on Amazon has enjoyed annual growth rates of 30% and specialist etailers such as Petco and Petsmart dominate the online market in the US.

There are also new players seeking to innovate the way pet supplies are sold. Bark, for example, offers dog owners a variety of monthly subscription services, including BarkBox, which consists of a “monthly-themed box of toys, treats, and unleashed joy, thoughtfully designed to satisfy every dog’s unique play style.”

The company, which currently only operates in the US, says it reaches over 1m dogs a month and while still loss-making, Bark reported a increase in revenues of 69% in its latest financial year, to $379m. Like other etailers that have taken the Direct-to-Consumer route, the cost of customer acquisition will likely cause losses to increase as Bark grows, and this remains the Achilles’ Heel for the DTC model.

To help move into profitability earlier, Bark has partnered with US retail giants such as Costco, Amazon and Target. The company argues that the pet industry is mostly dominated by a “legacy market approach” and so is ready for innovation.

Despite growing competition from supermarkets and online retailers, the traditional pet store sector will continue to grow as pet owners value the guidance and expertise that only hyper-local pet stores can provide through face-to-face interaction.

👉Read the case study to learn how Openbravo has helped Gloria Pets, a Spanish distributor of pet supplies, gain greater insight into the needs of its customers, specialty pet store retailers, and to optimize its processes for taking and preparing orders.