Openbravo helps retailers embrace the challenge of new payment options

Mobile payments are gaining traction around the world using different technologies, and retailers will increasingly want to offer the latest payment options. But what is the best way to do that, exactly?

While mobile payments may seem a niche payment option for most consumers, there is no doubt that they will continue growing in the next few years, creating new challenges for retailers who will need to support a wider range of payment methods for their customers.

To compete with retailers online and offline, retailers will need to offer what customers want, and not just in terms products and services. They also need to offer localized payment solutions and stored credentials to reduce checkout friction at the point of sale.

Alternative Payment Options Gain Momentum

In Europe, two-thirds of adults have a debit or credit card, while in other countries, such as India, layaways are popular. As NFC-enabled phones gradually penetrate the market, Google Pay, Apple Pay, and other NFC-based platforms will become an increasingly popular method for paying with a mobile phone, particularly in Europe.

Meanwhile, QR code-based payment systems do not require NFC-equipped phones, which is why they have been able to grow so rapidly. Instead, the consumer can use any Smartphone to scan a QR code that is generated on POS screen to make a purchase in a store.

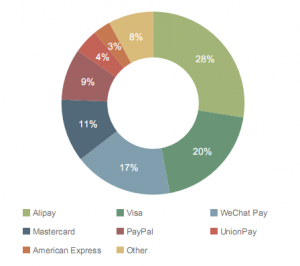

Payment Mechanism (Source: Juniper Research)

According to a new Juniper Research study, the largest global contributor to payments was currently QR code-based offline purchases for physical goods, which now account for one-third of all Chinese in-store payments by value. Alipay accounts for over half of China’s electronic retail transactions.

Even Japan, where sixty-five percent of transactions are still completed with cash, has seen a rise in domestic mobile payment platforms such as Nippon Pay. which represents a significantly unsaturated market for retailers.

New POS Solution Make It Easy to Accept Mobile Payments

Irrespective of the technology used, brick-and-mortar retailers have much to gain from embracing mobile payments because they are popular with consumers, modernize the in-store experience, and can encourage shoppers to spend more.

Retailers will need to accept localized mobile payment platforms as well as other non-QR-based technologies. But how exactly do retailers gain this capability?

Retails should look for a software solution which accepts QR code technology right out of the box, such as Openbravo, whose POS solution already accepts the most popular mobile payments platforms, AliPay and WeChat. Like Openbravo, these solutions should also have the flexibility to adapt and accept other cashless payment options and technologies as they gain acceptance.

To find out more about Openbravo’s mobile payment capabilities, watch our on-demand webinar, “Choosing the Right Mobile Payments Strategy for your Retail Business” or take a Product Tour today.

No Comment