Is your POS system ready for tomorrow’s cashless society?

Cards have long dominated retail spending by value as very few consumers expect to pay for big-ticket items in cash. Nowadays, many more shoppers expect to be able to use cards for low-value purchases as well, so the share of transactions taken by non-cash payments is now growing rapidly.

According to the Word Payments Report, non-cash transaction volumes are growing at around 10% a year globally, with the fastest growing regions being emerging Asia, which is growing at 25% a year, and Central Europe, Middle East and Africa, where growth is 17%.

.By 2021, the report predicts that nearly half of the global volume of non-cash transactions will take place in emerging markets.

Some countries are moving faster to the cashless society than others. In France, for example, only 17% of households prefer cash, while in the neighboring countries of Italy and Spain, the share is significantly higher, 39% and 42% respectively, according to a study by the European Central Bank.

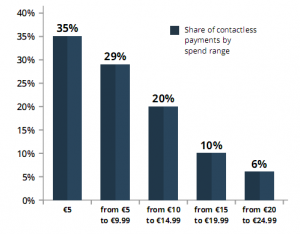

Contactless cards are poised to displace cash as the favored payment method for small purchases but adoption varies considerably. In the Netherlands, 9.6% of POS payments are done using contactless cards, in France, the figure is 1.7%, while in Spain, just 0.5% of POS transactions use contactless technology.

There is clearly huge room for growth in the use of contactless cards and it will accelerate the shift away from cash.

As non-cash payments become the norm, some retailers are considerinng whether the time is ripe to stop accepting cash completely.

In the US, some restaurants now only accept card payments and a small but growing number of non-food chains are also going cashless .

There are a host of reasons for not wanting to accept cash:

- Cash payments slow down checkout lines;

- Keeping lots of cash in the tills makes a store a tempting target for robbery – or for internal theft by employees;

- Time spent counting and reconciling cash could be better spent on other activities;

- The more cash you handle, the greater the risk from fraudsters trying to pass counterfeit banknotes.

The trend to move to cashless payments is being accelerated by the spread of digital wallets such as Apple Pay and Google Pay.

But there are good reasons to keep saying “cash is welcome here”:

- The most obvious one for retailers is that you get the money immediately;

- Another big benefit is there’s no merchant fee to pay for accepting cash

- A consumer may simply prefer to pay for a particular item in cash rather than put on a plastic card, so it’s important to be able to offer them the choice;

- Cash is non-discriminatory. Some consumers may not be able to obtain plastic cards, either because they are too young, don’t have a bank account or have poor credit.

Clearly, retailers do not want to risk alienating customers by moving too fast to abandon cash. But at the same time, they need to offer payment technologies that appeal to a new generation of digital shoppers.

As the payment landscape becomes more complex and dynamic, it is important that your POS system offers the flexibility to easily embrace different types of payment and so help you adapt to a world in which cash is by no means not dead, but it is no longer king.

To find out more about Openbravo’s mobile payment capabilities, watch our on-demand webinar, “Choosing the Right Mobile Payments Strategy for your Retail Business” or take a Product Tour today.